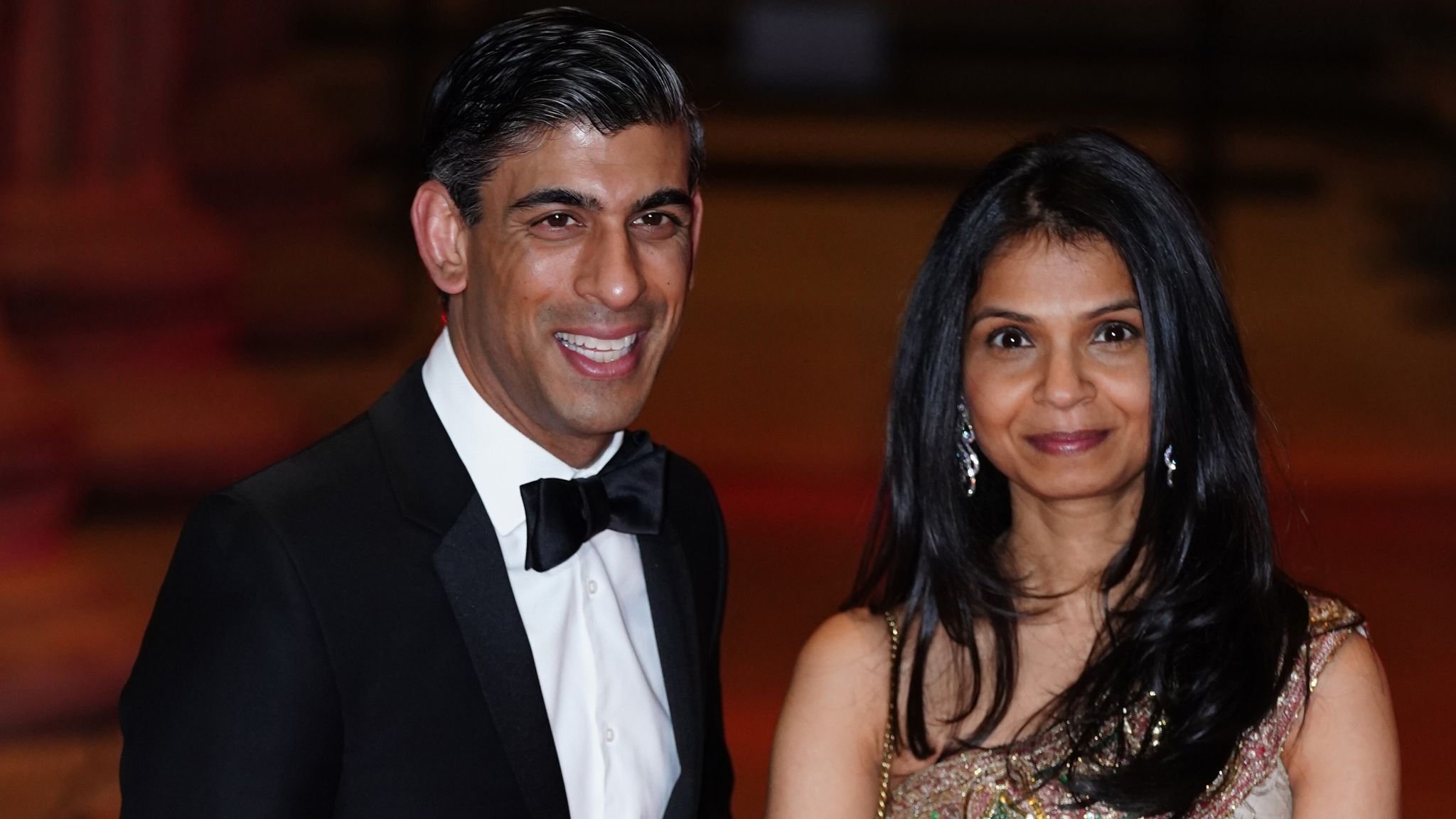

How Rishi Sunak’s wife avoids UK tax

It has been reported that UK chancellor Rishi Sunak’s wife, Akshata Murty, has non-dom tax in the UK allowing her to avoid UK tax on income arising outside the UK.

Non-dom tax status allows you to avoid UK tax on income earned outside the UK.

Ms Murty was granted non-dom status because she was born in India and holds an Indian passport which unlike the UK, doesn’t allow citizens to hold multiple passports.

So while she is resident in the UK, she never became a citizen and was therefore as an expat able to apply successfully to HMRC for non-dom tax status.

Ms Murty is therefore only liable for UK tax on income that arises in the UK.

Your domicile is not the same as your tax residence, allowing you to benefit from multiple countries tax allowances & tax rates.

We offer consultancies to help you make the most of a non-don tax status to help you minimise your taxes.

20% Off Annual Tax Return Service 🎉

20% Off Annual Tax Return Service 🎉

20% OFF!

Start the 2022-23 tax year off with 20% off our annual tax return service during April!